Why Supplemental Insurance

Q: Aren’t employer-sponsored health plans enough?

A: Employer-sponsored health plans or private pay insurance are no longer enough. When it comes to major illness, they pay their part, and you are left with the rest. Although out-of-pocket limits are $6,300 for an individual and $13,200 for a family, many don’t have the money to cover these amounts. Even a small medical event can put you at risk for financial catastrophe, especially when it comes to a heart attack, stroke or an illness like cancer. In addition to hospital and doctor bills there many treatments that aren’t covered by insurance and all kinds of non-medical expenses.

Supplemental insurance gives you a way to protect yourself and your family.

Q: What about the Affordable Care Act?

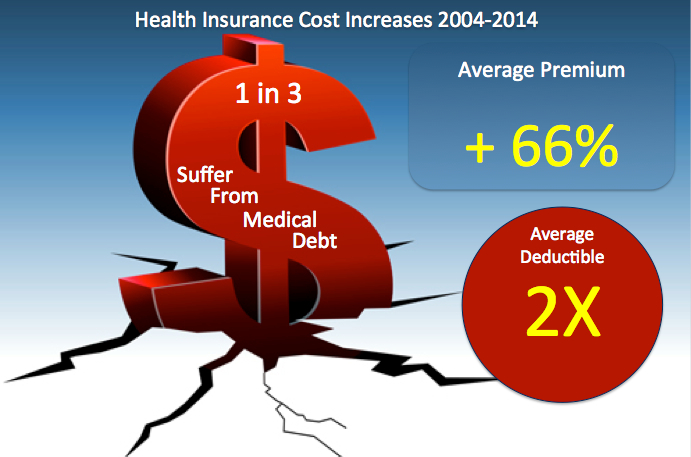

A: Healthcare in the U.S. has changed. In fact, a study by the American Medical Association found that since 2004, health insurance premiums have increased by 63% for individuals and 69% for families while the average medical insurance deductible has more than doubled, reaching $1,217. ¹ While employers typically bear the brunt of premium increases, employees too are experiencing the pain.

Since the introduction of the Affordable Care Act (ACA), also known as “Obamacare,” the trend in health insurance has been to increase deductibles and co-pays or co-insurance, which means individuals and families pay more out of pocket expenses. The concept of “cost-sharing” in which the insured bears an increased share of the cost was intended to prompt healthcare consumers to actively participate in controlling costs. When deductibles and out-of-pocket expenses were low, consumers had little incentive to challenge the cost of treatment.

Despite more control over their own care, a leading healthcare monitoring organization reports that higher deductibles are causing employees to go into medical debt or forego important treatment.² As medical costs escalate, consumers are often faced with the difficult choice of cutting essential household expenses, giving up treatment or taking on debt.

Q: Can I afford Supplemental Insurance?

A: These products are very affordable. Many programs can cover an entire family for under $50 per month. Some even less. Premiums depend on whether you chose individual or family coverage, how old you are and how much coverage you choose. Plans can be developed to fit most budgets.

Q: Are these policies in addition to other health insurance policies we already have?

A: Yes. Our benefits are paid in full in addition to any other insurance, including Medicare and Medicaid.

Q: Does someone have to be hospitalized to receive benefits?

A: No. Many of the benefits of these plans apply whether you are hospitalized or an outpatient.

Q: How are benefits paid?

A: For most policies benefits are paid directly to the policy holder unless designated otherwise by assignment. Policy holders may want to use the cash where it’s needed most, to help with non-medical expenses or to supplement a reduced income.

Q: If the coverage is through payroll deduction, can it be continued if the employee is no longer at the company?

A: The coverage continues as long as the premiums are paid. Premium payments can be billed quarterly, or via bank draft.

Sources:

1. Kaiser Family Foundation. Recent Trends in Employer-Sponsored Insurance. JAMA. 2014;312(18):1849. doi:10.1001/jama.2014.13248.

2. Kaiser Family Foundation. Medical Debt Among People with Health Insurance. Jan 07, 2014, Karen Pollitz and Cynthia Cox.